Curiosity in Ethereum, the second-largest cryptocurrency asset, is gaining momentum as soon as once more amongst retail and institutional buyers, as evidenced by a strong improve in its web staking inflows prior to now week in tandem with current enhancements within the value of ETH.

Constant Development In Ethereum’s Staking Internet Inflows

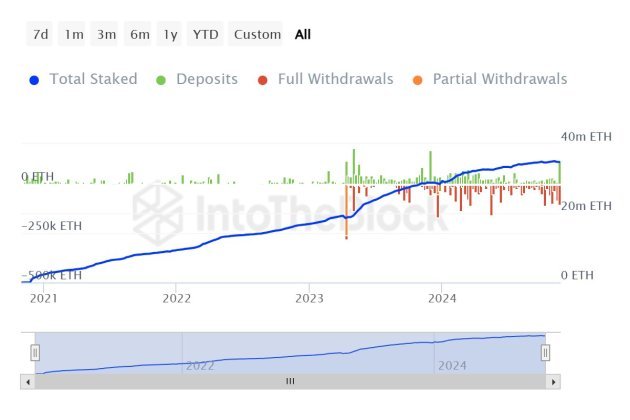

In a constructive growth, Ethereum’s staking has attracted vital capital over the previous week, resulting in a surge in its web weekly inflows. Maartuun, a market watcher and analyst at main on-chain knowledge and analytics platform CryptoQuant, reported the event, reflecting rising dedication.

The spike in staking exercise signifies that many buyers are excited about supporting Ethereum’s proof-of-stake (PoS) ecosystem whereas receiving passive returns. It additionally bolsters ETH’s strong safety and place within the cryptocurrency panorama.

Information shared by the analyst reveals that Ethereum staking noticed a web inflow of +10,000 ETH over the previous week, with 115,000 ETH being deposited and 105,000 ETH being withdrawn. This reveals that deposits have surpassed withdrawals as soon as once more after months of web outflows, marking a big change. With the full staked ETH rising once more, it signifies renewed confidence and optimism in staking as a long-term technique, which could possibly be essential in strengthening ETH’s ecosystem.

Addressing the elements behind the surge, Maartuun has identified a mixture of attainable elements. These embody rising ETH costs, improved staking infrastructure like liquid staking choices, and institutional gamers getting into the market.

Moreover, the knowledgeable highlighted that this surge in web inflows may be a response from long-term investors to Ethereum’s stability after the merger and their rising belief within the ecosystem.

Within the occasion that the present charge of deposits retains up, Maartuun is assured that the event may restrict the provision of ETH out there, which could have an effect on value actions. “General, this current influx is a constructive signal for Ethereum’s ecosystem and long-term development,” he added.

ETH’s Open Curiosity Reaches New Milestone

Ethereum has been seeing main developments these days in a number of key metrics, equivalent to its Open Curiosity (OI). ETH’s open curiosity skilled a notable uptick prior to now few days, surging to a brand new all-time excessive.

A report from CryptoQuant reveals that ETH’s open curiosity is valued at over $13 billion, representing a rise of greater than 14% prior to now 4 months. Moreover, funding charges reveal a constructive pattern, signaling that long-position merchants dominate the market. This spike reveals that curiosity in ETH’s derivative markets is rising sharply and rising market sentiment that helps value will increase within the brief time period.

CryptoQuant additionally revealed that Ethereum’s estimated leverage ratio has hit a brand new all-time excessive, reaching +0.40 for the primary time in historical past. This metric, which is decided by dividing the open curiosity by the alternate’s coin reserves, suggests an enormous rise in leverage positions, indicating elevated risk-taking by merchants in derivatives buying and selling.

Featured picture from Unsplash, chart from Tradingview.com

Trending Merchandise