Bitcoin surged to a brand new all-time excessive as we speak, reaching $106,533 and solidifying its place because the market chief on this ongoing bull run. The value motion has been exceptionally bullish, providing solely three fast possibilities for buyers to purchase small dips in current weeks. This relentless upward momentum has captivated the market as BTC continues to prepared the ground within the present cycle.

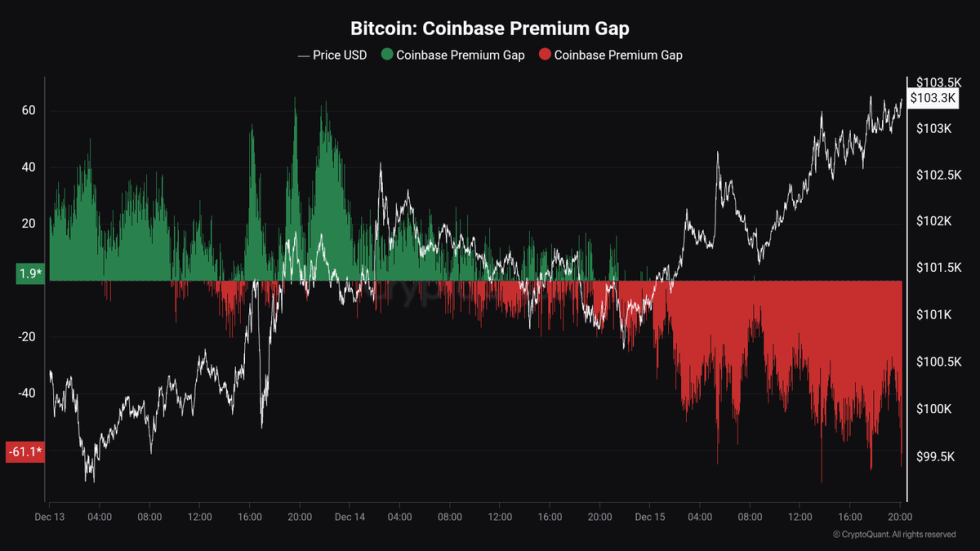

CryptoQuant analyst Maartunn just lately shared intriguing insights in regards to the drivers behind this historic transfer. In line with his evaluation, the Coinbase premium hole has considerably narrowed. This metric, which measures the distinction between BTC costs on Coinbase and different exchanges, signifies that U.S.-based institutional and retail demand may not have been the first drive behind the current rally. As an alternative, different market contributors or areas may gasoline Bitcoin’s push into worth discovery.

With BTC showing no signs of losing steam, market contributors carefully monitor its subsequent strikes. Will BTC consolidate above $100,000 or proceed its trajectory towards increased targets? Because the rally unfolds, this breakout underscores the worldwide nature of Bitcoin’s adoption and the various drivers influencing its worth dynamics on this historic bull cycle.

What’s Driving This Surge?

Bitcoin has been a relentless drive over the previous six weeks, with every worth surge accompanied by an increase within the Coinbase premium hole. This metric, which displays the distinction between BTC costs on Coinbase and different exchanges, is commonly seen as an indicator of U.S.-based demand. Nevertheless, the current rally above $106,000 has damaged this development, hinting at a big shift in market dynamics.

CryptoQuant analyst Maartunn shared key insights on X, mentioning that the Coinbase premium hole dropped whilst Bitcoin’s worth climbed. This deviation from the norm means that the newest bid pushing BTC into worth discovery didn’t originate from Coinbase buyers.

As an alternative, the demand seems to be coming from one other trade. Maartunn says it is a shocking growth, as such conduct hasn’t been noticed for a number of months.

Whereas Maartunn speculates that main exchanges like Binance may drive the present demand, the potential for over-the-counter (OTC) operations contributing to the rally is much less seemingly. Regardless, this shift underscores the worldwide nature of Bitcoin’s market and the way numerous contributors can affect its trajectory.

The change in demand supply raises questions on what’s fueling Bitcoin’s present run. Is that this an indication of broader institutional curiosity exterior the U.S., or are retail buyers from different areas stepping in? As BTC continues to push into uncharted territory, monitoring these metrics will probably be essential in understanding the forces shaping the market.

Bitcoin Enters Uncharted Territory

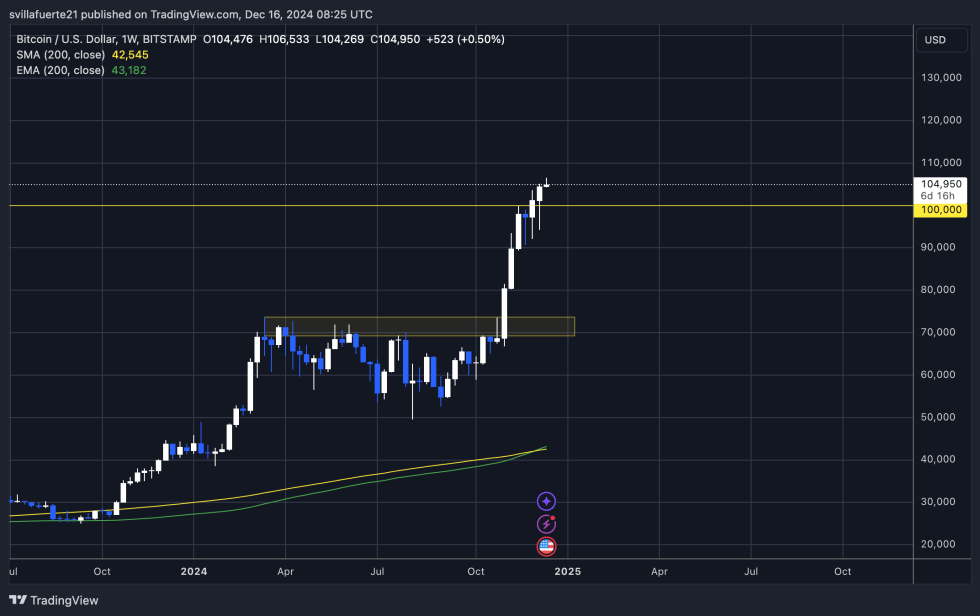

Bitcoin is buying and selling at $104,900, simply shy of its new all-time excessive of $106,533 set earlier as we speak. This milestone was accompanied by the best weekly shut in Bitcoin’s historical past, recorded at $104,427, additional solidifying the market’s bullish sentiment. Value motion has now entered uncharted territory—a part traditionally related to explosive progress as momentum builds and market contributors anticipate additional positive aspects.

Holding above the $100,000 psychological stage within the coming days is essential. If BTC maintains this help, it may set the stage for an enormous rally, probably surpassing analysts’ most optimistic targets. Key metrics similar to robust on-chain exercise, rising accumulation amongst whales, and low trade reserves add to the bullish case.

Nevertheless, the stakes are equally excessive on the draw back. A failure to carry the $100,000 mark may set off short-term corrections, inviting opportunistic merchants to capitalize on the volatility. Nonetheless, with Bitcoin’s historic tendency to thrive in worth discovery phases, market sentiment leans closely towards continued upside.

Featured picture from Dall-E, chart from TradingView

Trending Merchandise