The Bitcoin (BTC) market has undergone a exceptional restoration this 12 months, largely as a result of elevated reputation of Bitcoin ETFs. BTC reached an all-time excessive of $73,000 within the first quarter of the 12 months, sparking a bullish development that continues right this moment, with a latest excessive of $104,000.

The presidential election of Donald Trump has had a huge impact on this rise particularly over the previous month, as he has positioned himself as the primary pro-crypto President, picturing America because the “crypto capital of the world.”

Trump’s favorable place towards digital belongings has infused elevated optimism amongst traders, leading to elevated shopping for stress from Bitcoin ETF suppliers akin to BlackRock and Constancy. Notably, the highest 12 Bitcoin ETFs have emerged as the most important BTC holders, with a mixed asset worth of over $100 billion.

This determine represents some of the profitable ETF launches in monetary historical past, with the 12 spot Bitcoin ETFs now collectively owning roughly 1.1 million BTC—equal to about 5% of all Bitcoin in circulation.

Bitcoin ETFs Anticipated To Surpass 2024 Inflows

In a latest report, crypto asset supervisor Bitwise outlined three key components that recommend Bitcoin ETFs will proceed to see explosive progress in 2025. Initially, it’s vital to notice that the primary 12 months of ETF operations is usually the slowest.

Associated Studying

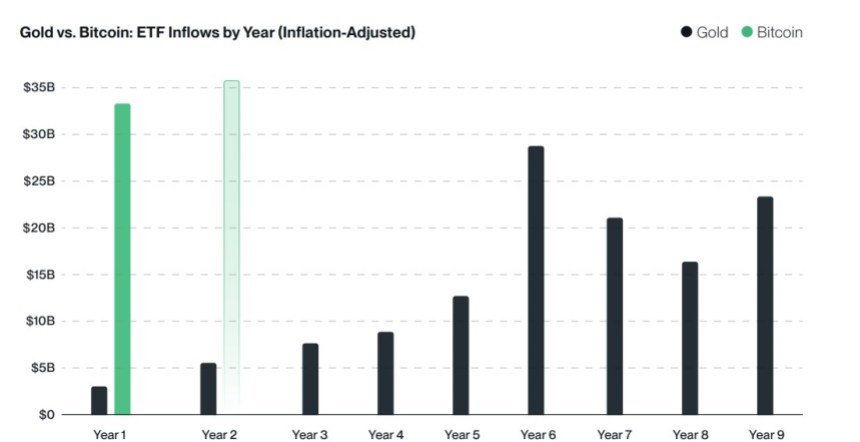

Historic comparisons with gold ETFs launched in 2004 present a major improve in inflows over subsequent years. As an illustration, gold ETFs started with $2.6 billion of their first 12 months, adopted by $5.5 billion within the second 12 months, and progressively increased quantities within the following years.

The agency means that if the 12 spot Bitcoin ETFs in the USA observe the same trajectory, 2025 might see inflows that far exceed these of 2024.

One other issue contributing to potential progress is the anticipated participation of main monetary wirehouses. Companies akin to Morgan Stanley, Merrill Lynch, Financial institution of America, and Wells Fargo have but to completely deploy their wealth administration groups to advertise Bitcoin ETFs.

As regulatory environments turn into extra favorable beneath Trump, these establishments are anticipated to unlock entry to Bitcoin ETFs for his or her shoppers, doubtlessly directing trillions of {dollars} into the crypto market.

Traders ‘Laddering Up’

Lastly, Bitwise has recognized a transparent development amongst traders generally known as “laddering up.” This sample signifies that preliminary small contributions to Bitcoin steadily result in growing investments over time.

The asset supervisor believes that many traders who entered the Bitcoin ETF market in 2024 will double down on their investments in 2025.

Associated Studying

The agency’s assertion that “3% is the brand new 1%” signifies growing acceptance of Bitcoin as a real asset class, which they imagine will lead traders to dedicate a bigger quantity of their portfolios to cryptocurrencies.

On the time of writing, BTC had consolidated above $100,900 following a 7% dip to $91,000 at the beginning of the month. Over the earlier 24 hours, the market’s largest cryptocurrency has seen an nearly 4% value improve.

Featured picture from DALL-E, chart from TradingView.com

Trending Merchandise